Last year I collaborated with Scottish Widows to tell you about the pension pay gap and the inequalities that women in particular face when it comes to their retirement funds. Now, I bet that year has simply flown by and many of you still haven’t found the time you need to prioritise looking into your pension forecasts. I get you, life is relentlessly busy these days. If that is the case for you, I want you to read this blog post and then immediately go to your calendar and physically schedule an hour in to do this. Do it now, because the earlier you do it, the more those savings are going to accrue for later in life.

Scottish Widows 2019 Women & Retirement Report

Each year (for the last 15 years!) Scottish Widows commission and publish a Women and Retirement Report. Given that there is a huge gender data gap in pretty much every single field of research, this is something I commend Scottish Widows for investing into and why I’m proud to work with them to promote both the report and the tools to help women that they have developed alongside it.

Scottish Widows 2019 Women & Retirement Report is celebrating 15 years of good progress with the savings gap closing to an extent but challenges still remain, women continue to be less likely to save and when they do, they save less of their income.

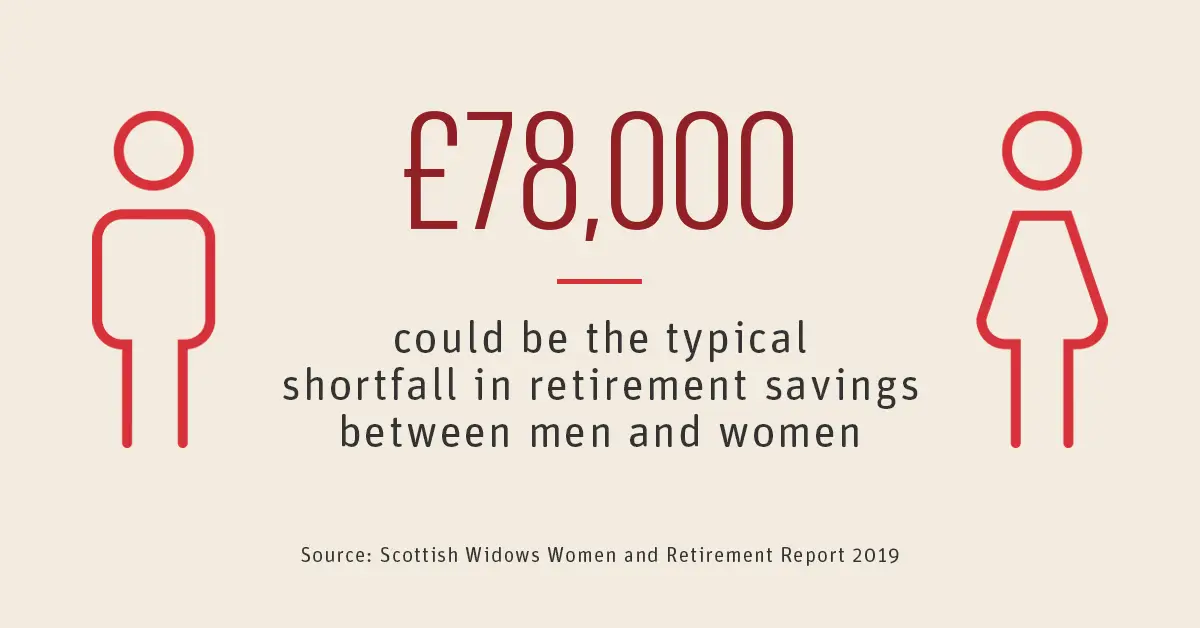

Scottish Widows’ modelling suggests that the typical young woman today could end up with a retirement pot £78,000 smaller than that of their male counterparts. That sizable gap could translate into nearly £3,000 less in income each year of retirement. Think of what you could be doing with £3000 a year – the holidays you could be going on!

Highlights (or lowlights) from this year’s Scottish Widows 2019 Women & Retirement Report include:

- Just 47% of women earning between £10,000 and £20,000 are saving enough for retirement compared to 65% of those earning £40,000 or more.

- Pension contributions stop after 39 weeks on maternity leave, and those who are trying to juggle work with childcare commitments often work part-time – 75% of these workers are women.

- The number of female entrepreneurs in the UK has hit an all-time high at 1.7 million, yet more than a third are saving nothing for their retirement. That’s almost 600,000 women who will have no savings to fall back on in later life. Less than half of self-employed women (46%) save the minimum recommended level, compared to 56% of women working as employees.

Your solution – visit Your Future Hub

So what can you do right now? Scottish Widows have developed “Your Future Hub”. It’s a dedicated hub full of really useful information, content and tools on retirement savings to help make it all a bit easier to get to grips with. In the hub you can find:

- The fascinating Scottish Widows 2019 Women and Retirement Report

- Pension Basic films – short films covering some of the key challenges women can face in saving for the future including part-time working, maternity leave, saving more and divorce.

- Tools and Calculators – on this page there is a range of tools to help you work out what kind of saver you are and how much to save.

- Pensions Wellbeing Guide – a downloadable booklet full of guidance and tips to help make saving for retirement easier to get to grips with, you can find out how to check how much you’ve already saved, if you’re on track for retirement and what to do next.

- Mumsnet content – Scottish Widows has been working with Mumsnet and Mumsnet users to create helpful content on retirement saving including top tips, case studies and films

I highly recommend you go and use these tools to help you check your pension health forecasts so you can make adjustments now if you need to.

My pension health

I love working with Scottish Widows as it forces me to take a hard look at my own pension health. As mentioned above in the report, I’m a woman who took two year long maternity leave periods. I’ve been working part-time since 2013 so from then my contributions have halved. In addition, I started a self-employed business in my ‘spare time’ in 2016. This tops up my part-time income but allows me to work flexibly around my children for half the week – however, unlike if I was employed full time, my self employed earnings are not contributing to a pensions pot at all. To try to counter this because I have a ‘good’ local government pension scheme, I’m going to try to arrange to increase my pension contributions through my current employer.

In researching for this blog post I’ve actually discovered that my local government pension scheme has ‘Shared Cost APCs’ which I had never heard of. Shared Cost APCs in my pension scheme cover the amount of pension “lost” during periods of unpaid additional Maternity, Adoption and Paternity leave or periods of unpaid authorised leave of absence. Shared cost means that if you want to cover such a period, the cost of buying the “lost” pension is shared between you and your employer, with your employer meeting 2/3rds of the cost (provided you make an election to buy the “lost” pension within 30 days of returning to work). Despite having two years of maternity leave no one ever mentioned this to me and I’ve now missed out. I’m really annoyed about that as I definitely would have done it. I would recommend that you look into whether your pension scheme has something like this if it could benefit you.

Facebook live with Mumsnet and Scottish Widows

Yesterday I took part in a live discussion with Scottish Widows and Mumsnet, broadcast on Mumsnet’s Facebook page. It was an insightful discussion and you can still watch it for the next week here. You can also still ask questions in the comments and have them answered by a Scottish Widows pension expert.

What I most took away from the chat was how we should really be making the most out of the ‘free money’ that our workplace pension schemes give us. The minimum an employer can match in a pension scheme is 3%. Would you turn down a 5% payrise? No, but by not putting into your workplace pension it is like doing that. It’s like throwing away free money! It’s part of your benefits package and we need to make the most of them if we can.

Interview with Scottish Widows Retirement Expert Jackie Leiper

I also took the opportunity to ask Retirement Expert Jackie Leiper at Scottish Widows, some questions that I think you, my readers, would be interested in specifically, here’s what she had to say:

You discussed how saving in your twenties is worth most due to compound interest and a certain amount of savings in your twenties can actually enable a career break in your 30s – can you remind me of the details of that?

Of course, this was part of some of research conducted by the Insuring Women’s Future Taskforce that I am a part of. We modelled and researched to see if there were any possible ways to make up for the pension savings you would missed out during a career break in your 30s, such as for maternity leave. We discovered that while it’s not possible to make up this amount after the event, it would be possible to offset this by saving more in your 20s. If you upped your contribution rates at a younger age when you potentially have less financial commitments, the effect of this and the compound interest you earn will put your savings in a much better place should you decide you take a career break a few years later.

You mentioned that even if your household income is over the £50k limit for child benefit you should still claim it in your name because it still gives you national insurance credits? Can you tell me more about this?

Yes that is correct! It’s important that you claim your child benefit to get your NI credits. If you earn between £50,000 and £60,000 you will receive some tax – 1% for every £100 over £50,000. For those earning more than £60,000 the charge is 100% – in effect, they receive no child benefit. However you can always opt not to receive the payments – and avoid the tax charge – but still get the entitlements in addition to the benefits such as your child being automatically issued with a National Insurance number before their 16th birthday. You can do this via an online form at gov.uk or contact the child benefit office by phone or post.

What pensions advice would you give a woman in her 20s?

Consider how much you can be saving and maximise your contributions as much as possible! As I mentioned due to the effect of compound interest it can have a real impact on your savings. Also take the time to educate yourself on your pension, which will help you consider your retirement savings when you make choices in the future, for example, if you are thinking about moving to part-time working – working flexibly might be a better option as it has less impact on your income and therefore saving potential.

How would your advice change for a woman in her 30s or 40s?

Women slightly later in life need to think more about the choices they are making in the here and now. For example, when you consider your childcare arrangements, its typical for a woman to cover nearly the full cost of this, meaning they are unable to save this.

Also, educate yourself around divorce. Pensions are often not discussed during divorce proceedings, partly due to the lack of experience in the law profession. But a pension is often the most valuable asset a couple has, and it’s worth more than the family property so it’s essential that it is split fairly to ensure women are well prepared for their future and retirement.

If you could only give one piece of pensions advice that women should do TODAY, what would it be?

Simply review your current arrangements – see how much you’ve been saving and try and increase your contributions by as much as you can. A tip that is sometimes given is every time you get a pay increase, increase your contributions at the same time and you won’t notice as much of a difference.

What pensions advice would you give a self-employed woman?

I would recommend speaking with a financial adviser who will look at your full savings picture. They are qualified to advise on the best methods to ensure you are ready for your retirement. They can set up an individual pension if that works for the individual’s situation and also recommend any other financial products that it might be worth considering such as life insurance.

Do pensions companies deliberately make pensions confusing to try and take advantage of people? How do we help ourselves to understand better?

No, definitely not! It’s one of our aims to help people engage with their pensions and try and make it as simple as possible! It’s something we try and consider when we develop products, campaigns etc. We have a wealth of material available which I’d recommend starting with to help you understand. We have a range of ‘Pension Basics’ films which try and explain a number of topics in short videos using straight-forward language. We have also created the Your Future Hub (link) which pulls together all the great educational material we have.

I’m sure you can agree that’s some really helpful and actionable advice there, big thank you to Jackie for taking the time to share her knowledge!

Summary

Big thanks to Scottish Widows for sponsoring this post and their work around improving the pension pay gap in women. I hope you have all found at least one piece of advice that you can personally action there. Let me know in the comments what you are going to do personally?

There is enough inequality in the world that we can’t change, this is something that many of us can do something about so now is the time to act and get those ‘free money’ and compound interest benefits.

Disclosure: This is a sponsored advertorial post. For my full disclosure policy please see my about page.

Really interesting post. Always good to be thinking about ways to counteract the gender pay gap and these are things that are hidden penalties

Thanks Matthew!

Thanks so much for this post. Super useful and definite food for thought! Things are a little manic at the moment but I am writing a note in my diary to visit the pension hub in January x

Thanks Sam, good luck!